Follow me on Bluesky: @janfichtner.bsky.social

Follow me on Bluesky: @janfichtner.bsky.social

Jan Fichtner is Senior Research Fellow in the Project “Climate change and global finance at the crossroads: Policy challenges, politico-economic dynamics, and sustainable transformation” at the University of Witten/Herdecke (Germany).

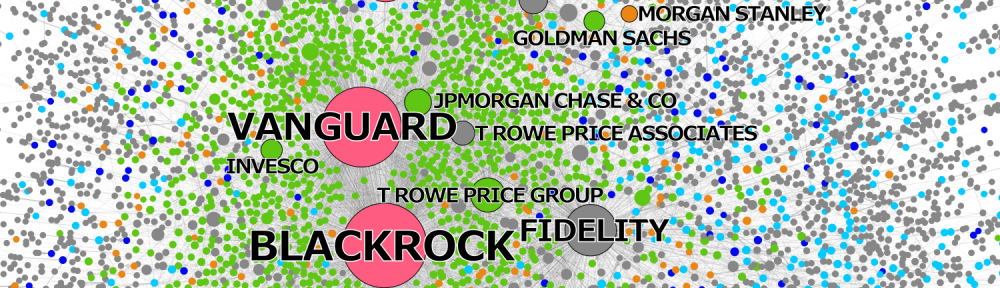

In the CORPNET project at the University of Amsterdam (2016-2020) Jan led the subproject on the rise of index providers and the ascent of very large passive asset managers, such as BlackRock, Vanguard and State Street – and their impact on global corporate governance, corporate control and climate change mitigation.

His research interests lie in the interdisciplinary field of International Political Economy, particularly Global Finance (index funds, index providers, ESG, sustainable finance, concentration of corporate ownership, structural power, financialization, hedge funds, and offshore financial centers).

Recent paper:

Mind the ESG gaps: transmission mechanisms and the governance of and by sustainable finance. DIIS Working Paper 2023: 4. By Jan Fichtner, Robin Jaspert & Johannes Petry.

Steering capital: the growing private authority of index providers in the age of passive asset management. Review of International Political Economy. By Johannes Petry, Jan Fichtner & Eelke M. Heemskerk.

Based on the above paper we have published an article in The Washington Post:

Index funds might sound boring. But who decides which countries and companies to include? and at TheConversation.com: Three financial firms could change the direction of the climate crisis – and few people have any idea. Both pieces are by Jan Fichtner, Eelke Heemskerk & Johannes Petry. Fichtner & Petry have published the blog post The New “Passive” Wall Street Counterparts for States in the Global South at Developing Economics.

Our “Steering capital” paper has been quoted by the Financial Times Editorial Board “The risks in the power of stock market indices“, the Financial Times “The index providers are quietly building up enormous powers“, Bloomberg “Private Equity Is Eating the U.K. Stock Market“, the Financieele Dagblad “Indexbouwers zijn de nieuwe poortwachters van de financiële markten, maar wie controleert ze?“, Morningstar “The Spotlight Turns on Index Providers“, Forbes “The Hierarchy Of Financial Superpowers – Who’s Really On Top?” and the Inter Press Service “Can Private Finance Really Serve Humanity?“.

The CORPNET working paper The New Permanent Universal Owners: Index Funds, (Im)patient Capital, and the Claim of Long-termism has been featured by Institutional Investor “Research: Asset Management Giants Don’t Walk the Walk On Long-Termism“.

Our CORPNET paper Hidden Power of the Big Three? Passive Index Funds, Re-Concentration of Corporate Ownership, and New Financial Risk (published in Business and Politics) has been featured by Bloomberg “BlackRock Takes on Ivory Tower Over Stock-Ownership Research“, Bloomberg Markets Magazine “We’re in the Middle of a Revolution“, CNN “Shareholder activism is on the rise, but companies are fighting back“, The Economist “Stealth socialism“, the Financial Times “Index fund managers are too big for comfort“, the Financieele Dagblad “Warren Buffett betoont zich een ware indexbelegger“, the Frankfurter Allgemeine Zeitung (1) “Die unheimliche Macht der ETF-Fonds“, (2) “Wie Blackrock & Co Unternehmen beeinflussen“, Harvard Business Review “How Big a Problem Is It That a Few Shareholders Own Stock in So Many Competing Companies?” and by The Wall Street Journal (1) “Are Index Funds Eating the World?” and (2) “Meet the New Corporate Power Brokers: Passive Investors“. We have published a short version of the paper for the general public at TheConversation.com under the title These three firms own corporate America (over 230,500 readers by February 2023).

The inaugural David P. Baron Award for the best article published in Business and Politics (BAP) in 2017 was awarded to our paper Hidden Power of the Big Three?

Our CORPNET paper Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network (published in Scientific Reports) has been featured by Algemeen Dagblad “Nederland met stip op 1 in lijst belastingontwijking“, by Bloomberg “Is the U.K. Already the Kind of Tax Haven It Claims It Won’t Be?“, by Der Standard “Niederlande größter Finanzkanal für Steueroasen“, by Malta Today “Scientists have found a way of showing how Malta is a global top ten tax haven“, by Technology Review Germany “Über die Niederlande ins Paradies“, by The Guardian “Netherlands and UK are biggest channels for corporate tax avoidance“, and by Spiegel Online “Paradise Papers: Niederlande – das Steuerparadies nebenan“. We have published a short version of the paper for the general public at TheConversation.com under the title These five countries are conduits for the world’s biggest tax havens.

Please use contact form to send a message: