Peer-reviewed publications:

Fichtner, J., Schairer, S., Haufe, P., Aguila, N., Baioni, R., Urban, J., & Wullweber, J. (2025). Channels of influence in sustainable finance: A framework for conceptualizing how private actors shape the green transition. Finance and Society, 11(1), 56–80.

Fichtner, J., Jaspert, R. and Petry, J. (2024). Mind the ESG capital allocation gap: The role of index providers, standard-setting, and “green” indices for the creation of sustainability impact. Regulation & Governance, 18:2, 479-498.

Babic, M., Dixon, A. and Fichtner, J. (2023). Varieties of state capital: What does foreign state-led investment do in a globalized world? Competition & Change, 27:5, 663-684.

Babic, M., Fichtner, J. and Heemskerk, E.M. (2022). Corporate Networks. In Pevehouse, J.C.W., and Seabrooke, L. (eds.): The Oxford Handbook of International Political Economy. Oxford University Press.

Johannes Petry, Jan Fichtner and Eelke M. Heemskerk (2021). Steering capital: the growing private authority of index providers in the age of passive asset management. Review of International Political Economy, 28:1, 152-176.

Jan Fichtner & Eelke M. Heemskerk (2020). The New Permanent Universal Owners: Index funds, patient capital, and the distinction between feeble and forceful stewardship. Economy & Society, 49:4, 493-515.

Jan Fichtner (2020), The Rise of Institutional Investors. In Phil Mader, Daniel Mertens and Natascha Van der Zwan, eds. International Handbook of Financialization. London: Routledge.

Victor Galaz, Beatrice Crona, Alice Dauriach, Jean-Baptiste Jouffray, Henrik Österblom & Jan Fichtner (2018), Tax havens and global environmental degradation. Nature Ecology & Evolution, published online 13 Aug.

Milan Babic, Jan Fichtner & Eelke M. Heemskerk (2017), States versus Corporations: Rethinking the Power of Business in International Politics. The International Spectator, published online 16 Nov.

Javier Garcia-Bernardo, Jan Fichtner, Frank W. Takes & Eelke M. Heemskerk (2017), Uncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network. Nature Scientific Reports, Vol. 7, Article no. 6246.

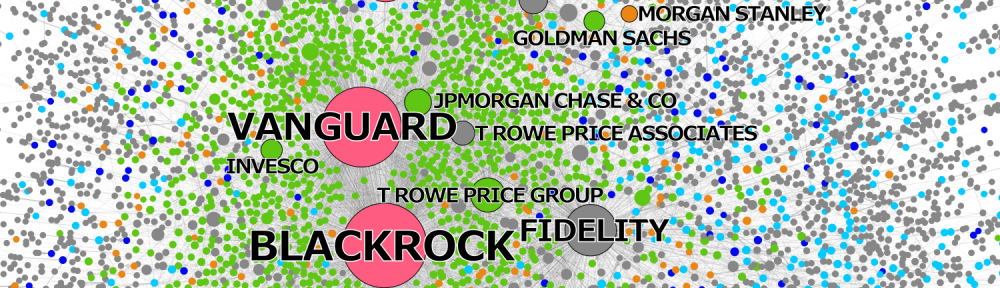

Jan Fichtner, Eelke M. Heemskerk & Javier Garcia-Bernardo (2017), Hidden power of the Big Three? Passive index funds, re-concentration of corporate ownership, and new financial risk. Business and Politics, Vol. 19, No. 2, pp. 298-326.

[Winner of the inaugural David P. Baron award for the best paper published in Business & Politics in 2017.]

Jan Fichtner (2017), Perpetual Decline or Persistent Dominance? Uncovering Anglo-America’s True Structural Power in Global Finance. Review of International Studies, Vol. 43, No. 1, pp. 3-28. (Click here for access to a preprint version of this article.)

Jan Fichtner (2016), The anatomy of the Cayman Islands offshore financial center: Anglo-America, Japan, and the role of hedge funds. Review of International Political Economy, Vol. 23, No. 6., pp. 1034-1063. (Click here for access to a preprint version of this article.)

Jan Fichtner (2015), Rhenish Capitalism Meets Activist Hedge Funds: Blockholders and the Impact of Impatient Capital. Competition & Change, Vol. 19, No. 4, pp. 336-352.

(Click here for access to a pre-print version of this article.)

Jan Fichtner (2014), Privateers of the Caribbean: The Hedge Funds-US-UK-Offshore Nexus. Competition & Change, Vol. 18, No. 1, pp. 37-53.

(Click here for access to a pre-print version of this article.)

Jan Fichtner (2014), Finanzialisierung und der Offshore-Hedge-Fonds-Nexus. Die Rolle der USA und Großbritanniens. In Marcel Heires and Andreas Nölke, eds. Politische Ökonomie der Finanzialisierung. Wiesbaden: Springer VS. pp. 115-130. (in German)

Jan Fichtner (2013), Hedge Funds: Agents of Change for Financialization. Critical Perspectives on International Business, Vol. 9, No. 4, pp. 358-376.

(Click here for access to a pre-print version of this article.)

Jan Fichtner (2013), The Rise of Hedge Funds: A Story of Inequality. Momentum Quarterly, Vol. 2, No. 1, pp. 3-20.

Other publications:

Jan Fichtner, Robin Jaspert & Johannes Petry (2023). Mind the ESG gaps: transmission mechanisms and the governance of and by sustainable finance. DIIS Working Paper 2023:4.

Jan Fichtner & Johannes Petry (2021). The New “Passive” Wall Street Counterparts for States in the Global South. Developing Economics.

Jan Fichtner, Eelke Heemskerk & Johannes Petry (2020). It’s the index, stupid! Our New Not-So-Neutral Financial Market Arbiters. Notes on the Crises (Guest Piece).

Jan Fichtner, Eelke Heemskerk & Johannes Petry (2020). Three financial firms could change the direction of the climate crisis – and few people have any idea. TheConversation.com.

Jan Fichtner, Eelke Heemskerk & Johannes Petry (2020). Index funds might sound boring. But who decides which countries and companies to include? The Washington Post.

Jan Fichtner & Eelke M. Heemskerk (2019), The New Permanent Universal Owners: Index Funds, (Im)patient Capital, and the Claim of Long-termism. CORPNET Working Paper.

Milan Babic, Jan Fichtner & Eelke M. Heemskerk (2018), Who is more powerful – states or corporations? TheConversation.com, July 2018.

Jan Fichtner (2018), Meet the New Owners of Corporate America. Cambridge Core blog, May 2018.

Jan Fichtner (2017), The Cayman conundrum: why is one tiny archipelago the largest financial centre in Latin America and the Caribbean?. LSE Latin America and Caribbean blog, November 2017.

Javier Garcia-Bernardo, Jan Fichtner, Frank W. Takes & Eelke M. Heemskerk (2017), These five countries are conduits for the world’s biggest tax havens. TheConversation.com, July 2017.

Carmel Shenkar, Eelke M. Heemskerk & Jan Fichtner (2017), The New Mandate Owners: Passive Asset Managers and the Decoupling of Corporate Ownership. CPI Antitrust Chronicle, June 2017.

Jan Fichtner, Eelke M. Heemskerk & Javier Garcia-Bernardo (2017), These three firms own corporate America. TheConversation.com, May 2017.

Jan Fichtner (2017), Explaining Cayman’s success through its role in the Anglo-American triangle. Cayman Financial Review, April 2017.

Jan Fichtner (2016), How Apple and Other Multinationals Avoid Taxes and Accountability: Analyzing Offshore Finance as a Complex Network of Ownership Ties. CORPNET blog post.

Jan Fichtner (2016), The Anglosphere, Dominance in Global Finance, and the Consequences of Brexit. Duck of Minerva blog post.

Jan Fichtner, Eelke M. Heemskerk & Javier Garcia-Bernardo (2016), Hidden Power of the Big Three? Passive Index Funds, Re-Concentration of Corporate Ownership, and New Financial Risk. CORPNET Working Paper.

Jan Fichtner (2015), The Offshore-Intensity Ratio: Identifying the Strongest Magnets for Foreign Capital. City University London. CITYPERC Working Paper Series 2015/02.

Jan Fichtner & Benjamin D. Hennig (2013), Offshore Financial Centres. Political Insight, Vol. 4, No. 3, p. 38. (Click here for access to a pre-print version of this article.)

Jan Fichtner (2013), The Real Size and Intensity of Offshore Financial Centers. tellmap.

Jan Fichtner (2011), Kaimane in Delaware. Le Monde diplomatique, Nr. 9394. (in German)

Jan Fichtner (2009), Activist hedge funds and the erosion of Rhenish capitalism: The impact of impatient capital. The Canadian Centre for German and European Studies Working Paper #17, York University Toronto.

Jan Fichtner (2006), Symbiotic Competitors – The Nature of Sino-US Relations. Journal 360°, Vol. 1, No. 1, pp. 62-68.